Changes to California’s Pay Transparency Requirements (SB 642) Effective January 1, 2026

Following the groundbreaking pay transparency law (SB 1162) that took effect in 2023, Governor Newsom has signed Senate Bill 642 (SB 642) dubbed the "Pay Equity Enforcement Act", which closes legal loopholes and significantly expands enforcement. This bill affects all employers with 15 or more employees and introduces three key shifts in how pay, compensation, and legal claims are handled in the state.

What’s Changing

1) Clarification to the definition of “Pay Scale”

The original 2022 law required employers with 15 or more employees to include a "pay scale" in job postings. The vagueness of that definition led many companies to post overly broad, meaningless ranges (e.g., "$80,000 - $500,000") that offered no real transparency.

What this means for the Public: Job seekers should expect more realistic and relevant pay ranges, reflecting what the employer intends to pay a new hire, not the maximum possible salary for a long-tenured employee in that role.

What HR Professionals Need to Know:

Good Faith Estimate: Your posted range must genuinely reflect the anticipated pay for a new hire. Posting an excessively broad range could be deemed a violation.

New Penalties: For failing to include the pay scale in a job posting, employers now face civil penalties of up to $10,000 per violation.

Remote Work Clarification: The Labor Commissioner confirms that the pay scale must be included in the job posting if the position may ever be filled in California, either in-person or remotely. This applies to out-of-state employers who hire remote California workers.

2) Total Compensation is Now “Wages”

SB 642 drastically broadens the definition of "wages" under the Equal Pay Act to include virtually all forms of non-hourly compensation.

The New Definition of "Wages" Includes:

Salary and overtime pay

Bonuses and profit sharing

Stocks and Stock Options (a major change for tech and finance sectors)

Life insurance, vacation, and holiday pay

Reimbursement for travel expenses and other allowances

What this means for the Public: When challenging pay differences for substantially similar work, employees can now compare their total compensation package, not just their base salary to their peers. Equal base pay is no longer enough to prove equity if, for instance, a male employee consistently receives a higher stock grant than a female employee performing the same role.

What HR Professionals Need to Know:

You must be able to justify differences in total compensation packages, including equity grants, based on legitimate, non-discriminatory factors (such as seniority, merit, or quantity/quality of production).

Salary History Ban: The existing ban on seeking or relying on an applicant's salary history remains in full effect.

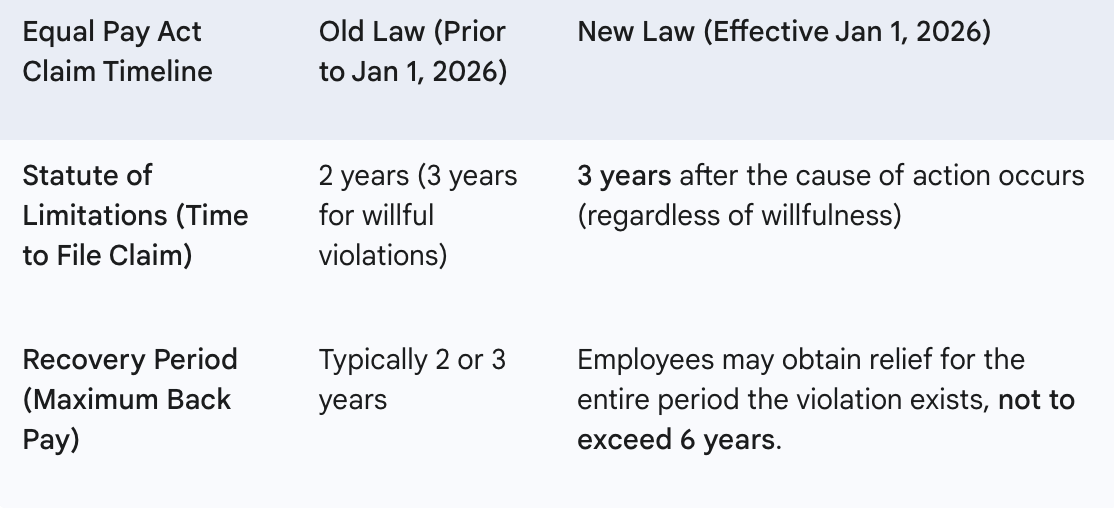

3) Extended Statute of Limitations and Recovery Period

The new law significantly extends the time frame for employees to file claims and recover lost wages, increasing the employer's potential financial liability.

What this means for the Public: Workers now have a larger window (three years) to file an Equal Pay Act claim, and they can potentially recover up to six years of back pay for the pay disparity.

What HR Professionals Need to Know:

Record Retention: The need to retain detailed compensation and wage records is more critical than ever, with a strong recommendation to keep records for at least six years to defend against potential claims.

Inclusive Language: The law updates the statutory wording to prohibit pay disparities between employees of "another" sex (rather than "opposite" sex), aligning with similar protections for race and ethnicity, and ensuring protection for non-binary employees.

Disclaimer: This information is for informational purposes only and does not constitute legal advice. Employers should consult with qualified legal counsel regarding compliance obligations